Key Statistics for SASSA Grant Payments Through Banks 2025

The number of South Africans depending on SASSA every month is staggering? Almost half the country leans on it, whether through pensions, child grants, or the famous R370 SRD support. That is not a cold number in a report — it is the difference between a fridge with food and one with empty shelves.

In 2025, SASSA grant payments have turned into one of the most powerful redistributive programmes South Africa has ever seen. Every month, billions of rands flow through banks, shops, and ATMs, to deserving families.

In August 2025, SASSA revealed an intricate web of banking partnerships that keeps money flowing to those who need it most. The scale? A breathtaking R22.4 billion in monthly payouts. And behind these payments is a buzzing web of banks, Postbank outlets, and digital gateways making sure the money reaches the right accounts.

So, let’s dive into the numbers that shape millions of lives across South Africa.

R22.4 Billion Every Month

The August 2025 report is staggering:

Think about that. Almost one out of every two people you meet in a taxi, in a shop, or at a clinic queue is connected to SASSA. This isn’t just money. It’s dignity, survival, and in many households, the only thing that keeps the lights on.

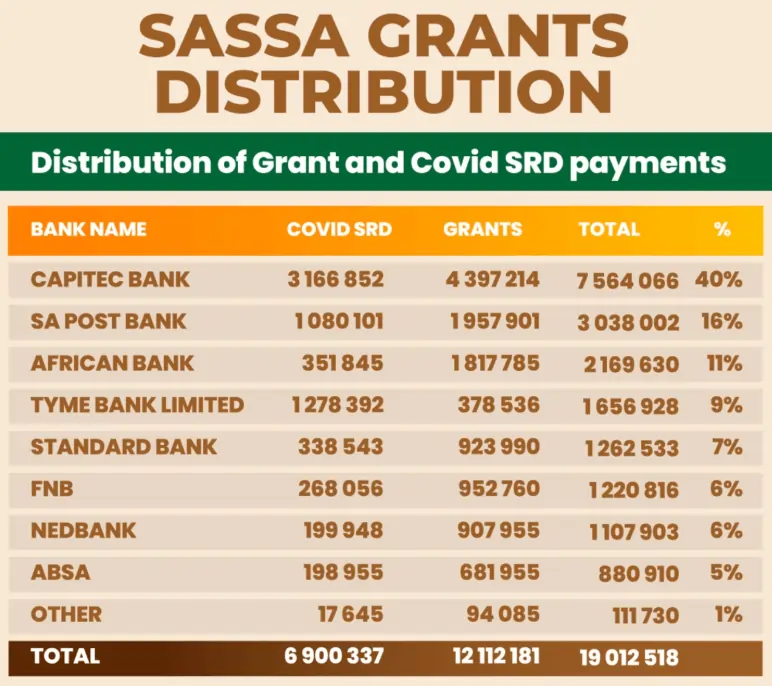

Banks Handling SASSA Payments

Ever wondered which banks pay SASSA grants? The SASSA banking distribution might surprise you with its diversity and reach across South Africa’s financial sector.

Capitec Leads the Way

Capitec has climbed to the top spot, handling a massive 40% of SASSA payments, about R7.56 billion every month. The bank has become the go-to choice for grant beneficiaries because of low fees and branches everywhere. I’m not surprised — Capitec ATMs are in almost every shopping complex.

But here’s the breakdown that’s particularly interesting:

TIt shows the real trust of people in Capitec Bank.

Postbank Still Standing Strong

Postbank is holding on with about 16% share, translating to almost R3 billion monthly. Despite the growth of private banks, Postbank still channels serious money:

Many rural communities and older beneficiaries stick with Postbank for one simple reason: those Gold and Black SASSA cards work, and people know them.

Other Banking Players

The remaining SASSA grant breakdown by bank shows a competitive landscape:

Notice how newer players like Tyme Bank have carved out significant market share? This spread is good news. It means no single bank has all the power.

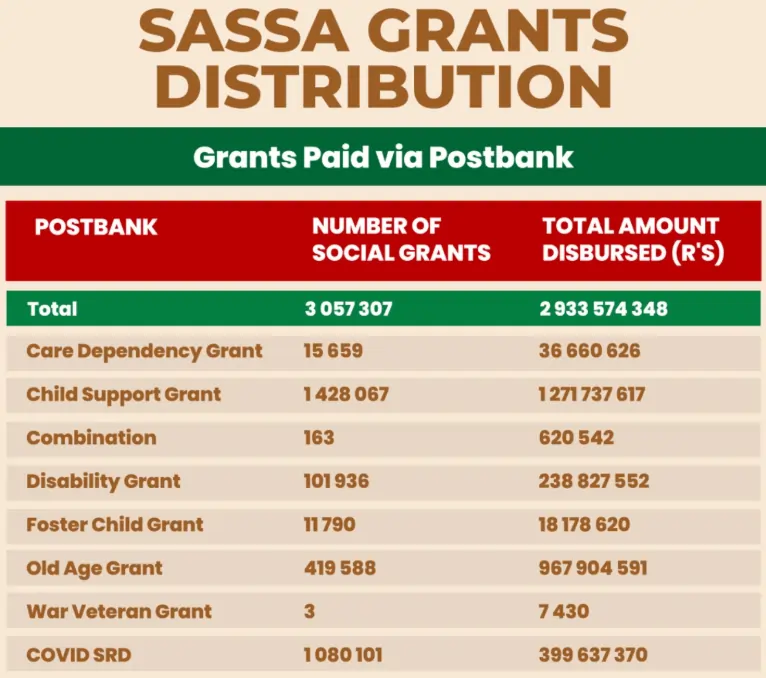

SASSA Grant Distribution Via Postbank

Child Support Grant Dominates Postbank

Here’s the big one: Child Support Grants. In August 2025, Postbank paid:

This is the biggest grant category. And honestly, it makes sense. Child poverty is still high, and without this money, school shoes, uniforms, and food would simply be out of reach for millions.

Senior Citizens Grant

The Old Age Grant is the second-largest stream:

For many gogos and mkhulus, this isn’t just “their money.” It often feeds children and grandchildren too. I have seen pension day turn into grocery shopping day for the entire household.

SRD Grants Still Flowing

The COVID SRD grant hasn’t disappeared. In fact, it’s become a permanent safety net:

Let’s be real. It shows how unemployment and inflation still grip the country, turning what began as a pandemic measure into a continuous safety valve.

Disability and Care Grants

The smaller categories also matter:

These may not make headlines, but if you’re in one of these families, you know how life-saving that money is.

Banking Flexibility Rules in 2025

Here is the thing, SASSA has finally introduced some common-sense banking rules:

That’s a relief. Nobody should lose money because they wanted lower fees or a closer branch.

What It Means for South Africa

So, what’s the bigger picture? A colossal R22.4 billion flows into the economy each month. Think of that as a permanent mini-stimulus package. Taxis, spaza shops, supermarkets — they all benefit when grants land.

Grants have proven to:

But let’s be honest: if distribution faltered, chaos would follow. Smooth banking is the backbone of the whole system.

Checking Your Payment Status

If you’re wondering whether your grant has landed, here are your options:

- Online: Check on the official SRD portal.

- Tool: SASSA Status Check tool.

- ATM balance check: Insert your SASSA card.

Conclusion

The 2025 stats don’t lie: SASSA grant payments are the backbone of survival for millions. With R22.4 billion injected monthly, it is the largest redistribution initiative South Africa has ever seen.

Will government always be able to fund it at this scale? That’s a million-rand question. But one thing is obvious: without these grants, poverty would explode overnight. For now, SASSA’s partnerships with banks and its new flexibility rules make the system stronger, and that is something worth holding onto.

FAQs

Editor at SGC

Sifiso Andreas

Hi! I’m Sifiso Andreas, with a background as a Grant Administrator at SASSA, I bring firsthand experience and deep knowledge of social welfare programs in South Africa. My goal is to help you navigate the complexities of social grants, scholarships, and government assistance with up-to-date resources and expert guidance. Join me for the latest updates and essential information on SASSA grants.