SASSA Warns Against Unlawful Deductions from Social Grants

Imagine, you are in a queue awaiting your social grant only to realise part of it is missing. You did not sign up for an insurance policy, you didn’t join a funeral scheme, and still the money is gone. This is not just a frustrating scenario. It’s the harsh reality for many South Africans depending entirely on their SASSA grants for their survival.

SASSA recently announced that unlawful deductions from social grants are on the rise and beneficiaries are being unfairly targeted. SASSA social grants have millions of beneficiaries. Who rely on these grants to feed their families, pay for essentials, and survive month to month. Every rand counts. So when unauthorized deductions happen then consequences go far beyond financial stress. Which can be hunger, medical neglect, and immense hardship.

I’ll discuss in detail about SASSA unlawful deductions problem, why its happening, how to fight back, and what you need to do to protect your money.

South Africa’s Social Grant System

Before I go into details, let’s step back and discuss available social grants in South Africa. These grant cover categories such as:

Millions of South Africans depend on social grants every month. It is a massive system, one of the largest social protection networks in Africa. If you take away even a slice, the impact can be crushing. For many households, a grant is the only stable source of income.

That is exactly why protecting these payouts is so crucial. If these scammers just deduct 10% unlawfully, it could result in a child missing meals or an elderly person not affording their medications.

Current Unlawful Deductions Issue

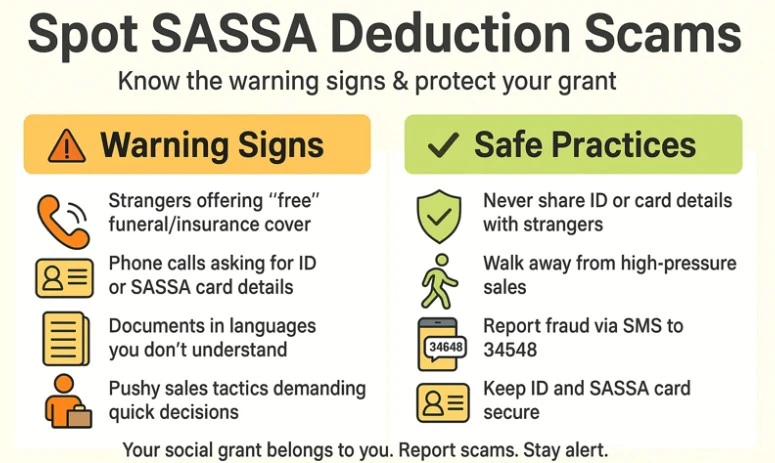

Recently, SASSA has raised alerts through posters, announcements, and community campaigns about unauthorized social grant deductions. The key concern? Insurance companies and funeral scheme operators are sneakily targeting beneficiaries with policies never approved or even known to them.

Here’s the typical pattern:

It’s pure exploitation. And it’s happening consistently enough that SASSA has had to roll out dedicated fraud reporting channels.

SASSA’s Official Position

Let’s make this clear: SASSA does not work with, endorse, or partner with any insurance companies or funeral schemes.

Here’s what SASSA emphasises:

So if someone tells you SASSA is “offering a policy” or is “working with an insurer,” that’s your red flag—it’s a scam.

Real Impact on Families

The consequences of these unauthorized social grant deductions extend far beyond numbers on a bank statement. 2 months back I talked with this grandmother, Maria from KwaZulu-Natal. Her only source of income is old age grant. She uses it to buy groceries for herself and her two grandchildren. For consecutive 2 months, she noticed R120 missing from her grant payout. She later discovered she was supposedly paying for an insurance policy she had never signed up for.

Her story is not a rare. In fact, such complaints continue to rise as more beneficiaries discover unexplained deductions. These practices erode trust and create unnecessary financial hardship.

Know Your Rights as a Beneficiary

Your grant money belongs to YOU. Full stop. Current CEO of SASSA, Mr. Themba Matlou said: “Your money is your money. If you qualify for a grant, it belongs to you, and SASSA has no right or authority to dictate how you use it”.

As a SASSA beneficiary, you have fundamental rights that no company can override:

Warning signs you are being targeted:

When in doubt, trust your gut. If something feels wrong, step back.

How to Dispute Unauthorized Deductions

If money has been taken from your grant without your consent, here’s your step-by-step guide:

Avoid Common Mistakes When Applying

While awaiting your pending application, remember common mistakes that lead to rejections so must avoid them:

Keep your ID book, SASSA card, and receipts safe so you have proof when lodging a dispute.

Conclusion

At the end of the day, the message is simple: your social grant belongs only to you. No insurer, funeral scheme, or financial provider has the right to touch it without your full consent.

Unlawful deductions are not just about money. They are about dignity, fairness, and survival. SASSA is fighting back, but you, as a beneficiary or community member, also have the power: report, dispute, and stay alert.

So next time you collect your grant, check your slip. If something looks off, don’t stay quiet. Act fast, protect your money, and spread the word.

Editor at SGC

Sifiso Andreas

Hi! I’m Sifiso Andreas, with a background as a Grant Administrator at SASSA, I bring firsthand experience and deep knowledge of social welfare programs in South Africa. My goal is to help you navigate the complexities of social grants, scholarships, and government assistance with up-to-date resources and expert guidance. Join me for the latest updates and essential information on SASSA grants.