SASSA Loans – How Beneficiaries Can Access Financial Help

Millions of South Africans are relying on SASSA grants every month to survive. However, there are cases when that money is not enough to meet the crisis or some unforeseen expenses. That is where SASSA loans are involved, small, short-term financial products that may assist the beneficiaries in addressing urgent needs.

Whether you were at all wondering whether you can borrow money on a SASSA grant or how to do it safely and not fall prey to scammers, then this guide is your guide. I will demystify it all – which includes the source of legal loans and the process of securing one, rates of interest, and the pitfalls.

Can You Get a Loan While on SASSA?

Yes, you can – not directly off SASSA itself. The South African social security agency does not give loans. Nonetheless, various registered financial institutions also provide loans to SASSA beneficiaries, and you can borrow a sum of money based on your regular grant money.

Your SASSA grant is considered as an income stability by banks and micro-lenders. This is to mean in case you are getting a monthly grant of old age, disability or child support, you may be taken up on a small loan which will be between R500 to R5,000, depending on your ability to pay.

But be cautious. There are unregistered lenders who take advantage of the people in debt by using the name of SASSA. Never sign anything without checking to ensure that the lender is registered by the National Credit Regulator (NCR).

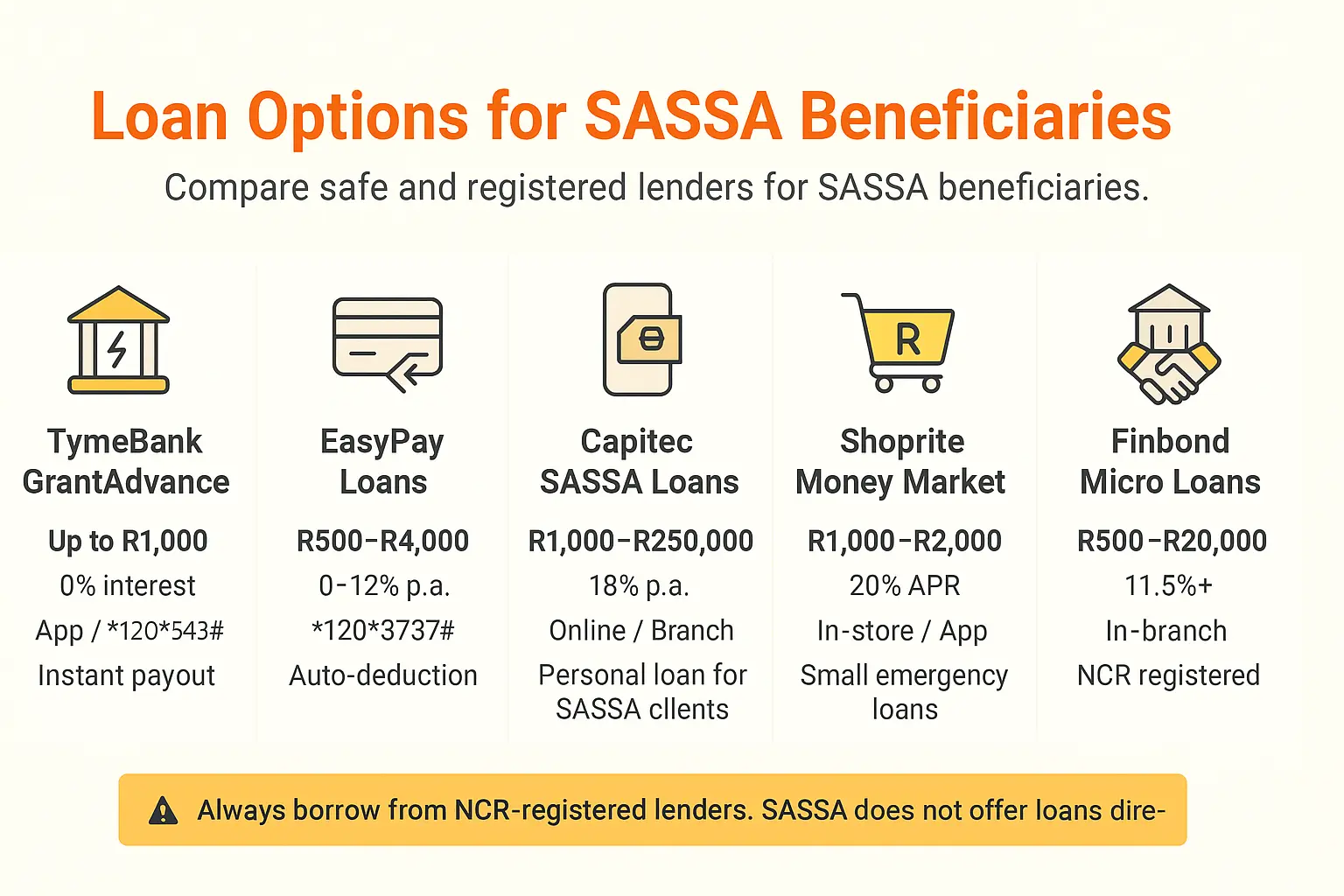

Types of Loans for SASSA Beneficiaries

Several institutions provide credit to the SASSA clients. The most common and reliable are the following in South Africa:

SASSA TymeBank Loan

TymeBank is my number one pick to make in 2025 and this is why. They have what they refer to as GrantAdvance and that is not exactly a loan but acts in the same manner. Grant Advance allows eligible recipients of social grants to get up to R1,000 of their social grant in advance ahead of the time they are paid.

This Grant Advance is totally free and there is no interest or charge and you will pay automatically when you get the next grant GrantAdvance By TymeBank to SASSA Grant Beneficiaries. You read that right. Zero interest. That is almost unheard of in the lending market of South Africa.

GrantAdvance will be made available between 15th and 29th day of every month and the maximum advance will depend on your grant type TymeBank by Grant Advance on behalf of SASSA Recipients. So when you are on the Old Age Grant or Disability Grant, you may well claim more than a person on the Child Support Grant. Old Age and Disability recipients are entitled to a maximum of R1,000, with Child Support and Care Giver grants being limited to less than R150.

The application process? Ridiculously simple. Install the mobile app of TymeBank, tap on GrantAdvance, confirm your eligibility, and as a result, get your advance deposited in your account immediately GrantAdvance. Alternatively, call any phone *120*543#, option 4, SASSA Grant Advance and get immediate cash SASSA Grant Advance.

Note: Grant Advance cannot be provided to recipients of Social Relief of Distress grants, it is offered to General Grant recipients who are paid via TymeBank.

EasyPay Loans

One of the most widespread ones is EasyPay loans that are associated with SASSA cards. They enable the beneficiaries to take a loan that is automatically repaid by the next payment of the grant.

Nevertheless, this convenience is hazardous in case you are not cautious. EasyPay loan deduction directly deduces out of your SASSA card balance, which implies that your next payment can be less than that anticipated. Examine the interest and charges at all times.

Capitec SASSA Loans

Capitec does not offer a product named SASSA loan, but numerous SASSA users who get their grants transferred to a Capitec account can use the opportunity to take a personal loan.

The check used by Capitec is based on your SASSA income, expenses and credit score which is an affordability check. On approval the funds are deposited immediately on your account. Loans are normally between R1, 000 and R250, 000, although SASSA customers are normally considered in smaller amounts.

Shoprite Money Market Loans

Some SASSA recipients get access to small credit offers with lending platforms through Shoprite Money Market. They can be limited to R1,000 to R2,000 and should be used in situations where there is a need such as groceries or power.

The application is possible in-store at the Money Market counter or by the Shoprite app, and the ID and SASSA card are always required during the application.

Finbond Mutual Bank Options

Another lender registered in NCR which offers short term micro-loans is Finbond Mutual Bank. They specifically target the lower income earners including SASSA beneficiaries. SASSA beneficiaries can access loans ranging from R500 to R20,000. Their repayment conditions are easy with the normal progression of 1 to 6 months depending on how often you receive income.

Finbond loans are the one that is best suited to individuals who like to visit a physical branch and meet a real consultant.

How to Apply for SASSA Loans?

The digital tools and mobile access have helped to make it easier to apply to a SASSA loan. You can use the internet, cell phone or face-to-face.

SASSA Loan Online Application

A number of lenders also provide online applications of SASSA loans on their websites. You’ll need:

Your application is received and completed after 24-48 hours. In case approved the funds are paid to your bank account which is linked to the grant.

How to Apply for a SASSA Loan via Cellphone

With other lenders, such as EasyPay you can dial *120*3737# to start loan procedure.

For TymeBank GrantAdvance specifically, dial *120*543#, select option 4, choose SASSA Grant Advance, select your eligible amount, and receive instant payment.

In Person Application

Go to any NCR-registered branch of microfinance such as, Finbond or Shoprite Money Market, and apply personally. Carry your SASSA card, ID and address. Before you finalise your application, a consultant will assist you in checking whether you can afford it or not.

Documents and Requirements for Loan Applications

Unless indicated otherwise, you will need the following to apply to a loan as a SASSA beneficiary:

Note: It is advisable to make sure that you have verified the requirements of the lender, as they may require additional information such as payslips (in case you have other sources of income) or the most recent SASSA receipt.

Interest Rates, Fees and Repayment Procedure

There are many different interest rates and charges:

Repayment will most likely be through debit order on your next SASSA grant date. Failure to do so will lead to a penalty fee and even adverse credit-bureau records.

It is important to always request that the contract be written to reflect all fees the initiation fee, service fee, and interest fee.

Instant SASSA Loans: Reality Check

The web is crammed with the advertisements purporting to provide instant SASSA loans. The majority of them are fraudulent or exploitative. The legit loans require a minimum of 24 hours to be done, since credit checks are obligatory.

When a web site offers to approve instantly with no documentation, alarm bells should go off. It is safer to make an application by means of registered providers such as TymeBank, Finbond, or Capitec.

Note: SASSA will never send SMSes / emails with loan offers.

SASSA Loans Status Check

After applying, you can check a SASSA loans status to know whether your application is approved or not.

You can:

When your loan is refused, the lenders need to give a response as to why they refuse to grant it to you, like low credit score or outstanding debt. You can ask TransUnion or Experian to provide you with a free credit report once in a year.

Alternatives to Taking a SASSA Loan

You should borrow using the following options that are not so risky:

It might appear that borrowing is a fast solution, yet this can be a further source of financial strain unless it is handled with a long-term plan. It is always better to first find other alternatives to debts.

Conclusion

SASSA loans may prove to be a savior of all, but it has to be applied, and in the proper channels. The fact is, SASSA does not lend money, however, it can be lent by approved financial partners.

When you think of a loan, you need to do some research and compare the loan options, look through the fine print and make sure to avoid a lender that is not registered. One prudent investment today will put you out of some high hopes tomorrow.

FAQs

Editor at SGC

Sifiso Andreas

Hi! I’m Sifiso Andreas, with a background as a Grant Administrator at SASSA, I bring firsthand experience and deep knowledge of social welfare programs in South Africa. My goal is to help you navigate the complexities of social grants, scholarships, and government assistance with up-to-date resources and expert guidance. Join me for the latest updates and essential information on SASSA grants.